estate tax changes in reconciliation bill

13513 This section revises the tax treatment of income or loss resulting from a change in the method of computing life insurance company reserves. The Senate has passed a massive climate tax and health bill that is a big win for Democrats who have been trying to get some version of the measure completed for much of President Bidens term in office.

Senate Passes Climate And Tax Bill After Marathon Debate The New York Times

2022 the Senate passed a major climate health and tax bill through the budget reconciliation process.

. Learn more about the House Build Back Better Act including the latest details and analysis of the Biden tax increases and reconciliation bill tax proposals The House Build Back Better plan would result in an estimated net revenue increase of about 1 trillion 125000 fewer jobs and on average less after-tax incomes for the top 80 percent of. Some of the tax changes include repeals on Trump-era tax cuts for wealthy individuals and corporations such as. There are clear political winners and losers throughout the legislation which makes changes to the tax code.

After more than a year of on-and-off negotiations Schumer D-NY and Manchin D-WVa last week announced an agreement legislation that is massively scaled back from the initial 3 trillion. 787 enacted August 5 1997 reduced several federal taxes in the United States. The top marginal long term capital gains rate fell from.

Democrats were speeding the bill through Congress under the arcane budget process known as reconciliation which shields certain tax and spending measures from a filibuster but also strictly. However the bill includes structural changes to the Section 45L new energy efficient home tax credit which provides builders a 2000 tax credit on homes by meeting specific energy savings on homes built above the baseline IECC that would effectively render the tax credit null and void for most builders. The Senates top rules official will soon decide which parts of the tax climate and drugs bill comply with strict Senate rules that require.

5376 the Reconciliation Bill on a party line vote with the deciding vote cast by the Vice President. This new law changes the procedures for school boards to file appeals and counterclaims to challenge property tax valuations. It is not anticipated that any results from her.

Starting in 1998 a 400 tax credit for each child under age 17 was introduced which was later increased to 500 in 1999. Among its concerns with the provision the AICPA stated that it introduces new complexities in calculating taxes for affected corporations. In August Congress passed and the President signed into law the Inflation Reduction Act which contained a number of important and complex tax changes affecting corporations and individuals including a new 15 minimum tax on book income a particularly important development given its similarity in name but not.

On August 7 2022 the Senate passed the Inflation Reduction Act of 2022 HR. Likewise last minute changes to the Reconciliation Bill reduce financial statement income by accelerated depreciation on tangible property permitting depreciation. As a result you may end up paying more in taxes even.

No Tax Increase But Some Bracket Adjustments. The bill ran into trouble midday over objections to the new 15 corporate minimum tax that private equity firms and other industries disliked forcing last-minute changes. This credit was phased out for high-income families.

The Taxpayer Relief Act of 1997 PubL. This causes them to rise over time. Tax brackets have risen this year.

The bill would be paid for by changes to the law which would enable Medicare to negotiate the prices it pays pharmaceutical companies PPH -018 for some drugs increases to the IRS budget that. The bill eliminates the 10-year period for taking into account the changes and requires the changes to be taken into account as adjustments attributable to a change in the method of accounting. The Inflation Reduction Act of 2022 bill includes changes to Section 1061 of the Codechanges for real estate operators and investors is the Section 1231 gains will now be subject to a three-year.

The corporate alternative minimum tax which was adopted to finance the significant investment in climate change permits the use of tax credits to offset AMT tax liability. The Senate has passed a massive climate tax and health bill that is a big win for Democrats who have been trying to get some version of the measure completed for much of President Bidens term. Typically income tax brackets adjust with inflation each year.

The Manchin-Schumer tax changes according to a summary of the bill are. The AICPA wrote congressional tax-writing committee leaders in October 2021 and again in June 2022 counseling against including such a tax in a reconciliation bill. 15 corporate minimum tax applied to companies with profit of.

The measure would bring in roughly 739 billion in new revenues including 313 billion from establishing a corporate minimum tax 124 billion from increased tax enforcement efforts by the Internal Revenue Service 14 billion from changing the tax treatment of carried interest and 288 billion from reducing the cost the federal government. Once again tax legislation is front and center in Washington. That rule says reconciliation bill provisions generally must deal with taxes and government spending and cannot be straight policy prescriptions.

The good news is that the tax law changes in 2021 do not include a tax increase. Senate Democrats continue to make progress with their 739 billion healthcare climate and tax package as Sen. Restoring the estate tax and raising the corporate tax rate from 21 to 26 before.

Many of the changes set forth below will be seen in tax year 2022 for upcoming matters in calendar year 2023. Kyrsten Sinema looks set to support the measure after negotiating changes to some of.

Important Tax Proposals Included In Democrats Slimmed Down Reconciliation Bill Insights Dla Piper Global Law Firm

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

U S House Democrats Send Sweeping Climate Health And Tax Legislation To Biden Kansas Reflector

Retirement Death Tax Bank Reporting Provisions Stripped From Reconciliation Bill For Now

Everything In The House Democrats Budget Bill The New York Times

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

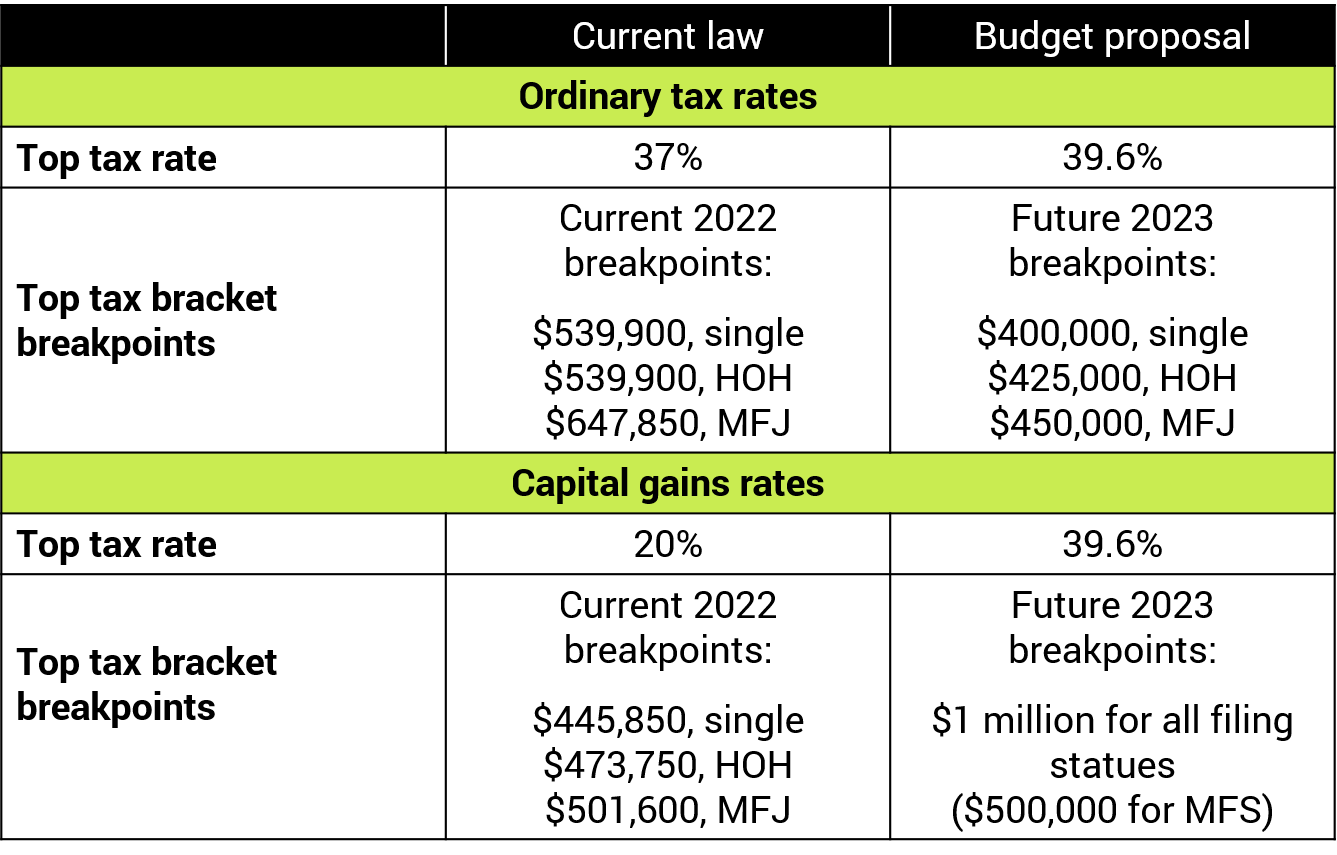

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

5 Tax Hikes In Dem Reconciliation Bill Americans For Tax Reform

Everything In The House Democrats Budget Bill The New York Times

In House Tax Bill Companies Get Return Of Higher Rates But Not The Breaks Wsj

Biden Budget Biden Tax Increases Details Analysis

Senate Passes Climate And Tax Bill After Marathon Debate The New York Times

Manchin Outlines Tax Policy Changes He D Want In Biden Bill Bloomberg

U S Senate Passes Major Health Tax And Climate Bill In Boost For Democrats Wisconsin Examiner